Fintech application development isn't your average coding gig. You're not just spinning up another social media app; you're building the digital vaults that hold people's money, their savings, their futures. It's all about trust and precision, and the stakes are terrifyingly high from the very first commit.

This is why that initial discovery phase, the part everyone wants to rush through, isn't just a box to check on a project plan. It's the most critical part of your entire journey. Skip it, and you're building on quicksand.

Why Fintech App Development Is a Different Beast Entirely

It is so tempting to jump straight into the code. I get it. As engineers, our hands itch to build things. But in the world of finance, that impulse is a direct flight path to disaster.

I once watched a promising project completely implode because the team built a technically brilliant solution... for a problem nobody actually had. They were so focused on the what that they forgot the who. They skipped the most important step: understanding the human element.

Before a single line of code gets written, a successful fintech project has to start with deep, almost obsessive discovery. This isn't just about listing features and picking a tech stack; it's about mapping the precise financial headache you are trying to solve. Who are you building this for? Is it a small business owner drowning in cash flow anxiety, or a gig worker trying to make sense of retirement savings? What keeps them up at night?

This is where you have to stare the hard questions in the face.

The Niche vs. Broad Platform Dilemma

One of the first major decisions you'll face is about scope. Are you building a laser focused tool that does one thing exceptionally well, like a specialized invoicing app for freelance photographers? Or are you aiming for a broader platform, like a comprehensive personal finance dashboard?

- Niche Products: These often have a faster path to market and can build a fiercely passionate initial user base. The real challenge is making sure that niche is big enough to sustain a business long term.

- Broad Platforms: While they have a much larger potential audience, they also face a ton more competition and require significantly more capital and development time to build a compelling MVP.

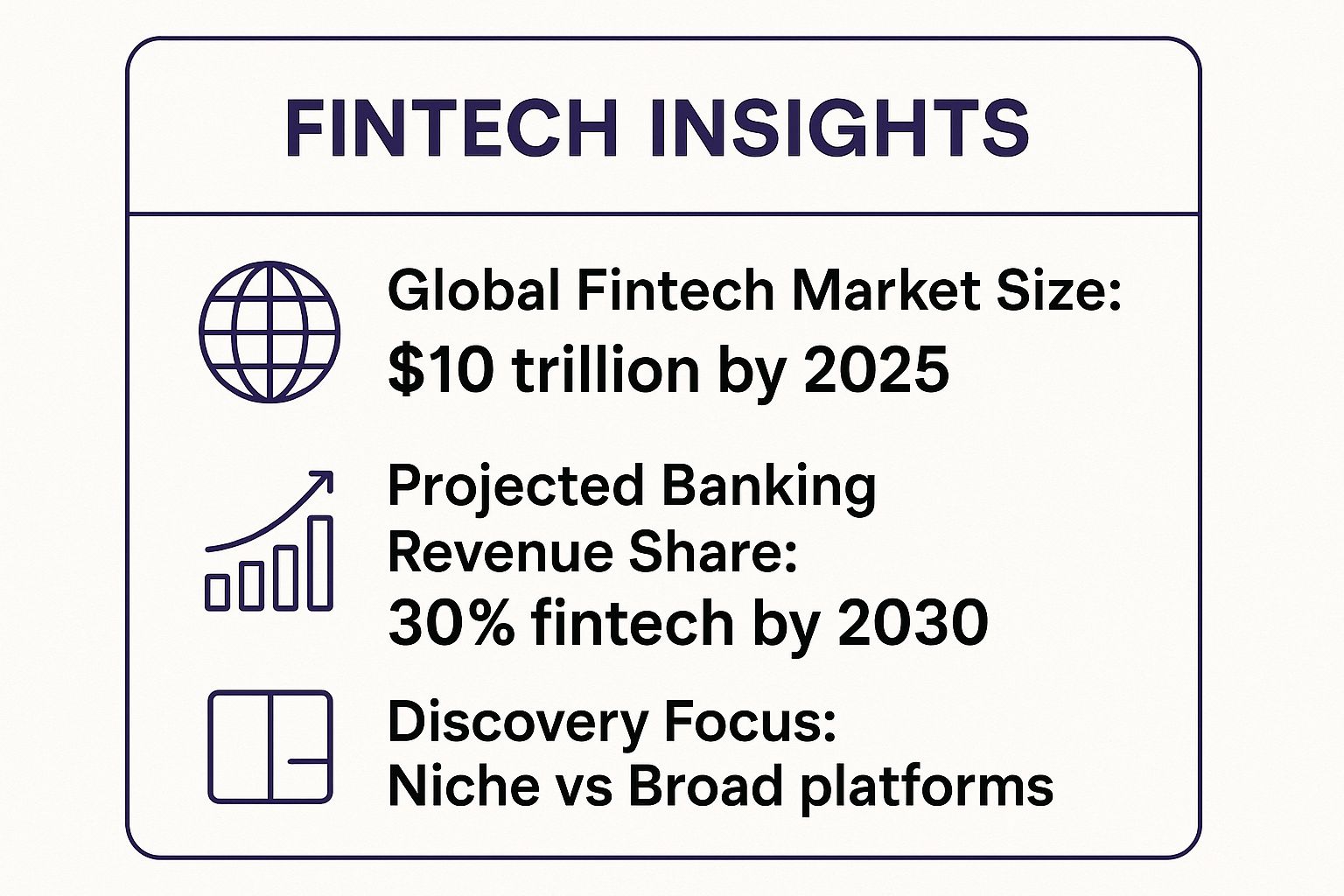

Let's pause and reflect on the market for a second. The global fintech space is exploding. Projections show a compound annual growth rate of about 16.8% from 2025 through 2034. By 2030, fintech revenues could surge by $1.5 trillion, making up nearly a quarter of all global banking revenue. These fintech statistics highlight just how massive the opportunity is.

This chart breaks down the key data points every founder should consider before diving into development.

These numbers really underscore the scale of the opportunity, but they also scream how important it is to carve out a defensible position, whether that's through a sharp niche focus or a well funded broad approach.

Choosing Your Tech Stack and Architecture (Without Tearing Your Hair Out)

Alright, let's get into the bones of your project. Choosing your technology stack is where the future of your fintech application is decided. This isn't about chasing the hot new JavaScript framework making waves on Twitter; it's about selecting battle tested tools for a job where security, scalability, and compliance are non negotiable.

The first major crossroads you'll face is an architectural one: monolith versus microservices. I've seen this decision paralyze teams for weeks. On one hand, a monolithic architecture lets you move incredibly fast at the start. Everything is in one big, cohesive codebase, which makes that initial deployment feel beautifully straightforward.

On the other hand, I've also seen that same speed lead to a tangled mess of technical debt a year down the road. Suddenly, a small change in one part of the app breaks something completely unrelated, and development grinds to a halt. This is where the microservices argument starts to sound very appealing.

Monolith vs. Microservices: A Fintech Perspective

A microservices architecture involves breaking your application down into smaller, independent services. Each service handles a specific business function, like user authentication, transaction processing, or account statements. This sounds great on paper, but it introduces a whole new layer of complexity right from the start.

You're no longer managing a single application; you're orchestrating a whole fleet of them. This means more complex deployments, tricky networking, and a greater need for robust monitoring. The system itself becomes a new character you have to manage.

So, which path should you choose for your fintech application development? The decision boils down to your current stage and long term vision. The table below outlines the key trade offs from a fintech perspective.

Fintech Architecture Trade Offs: Monolith vs. Microservices

| Factor | Monolithic Architecture | Microservices Architecture |

|---|---|---|

| Initial Speed | High. Faster to build an MVP and get to market. | Low. Significant upfront investment in infrastructure. |

| Team Size | Ideal for small, co located teams. | Better for larger, distributed teams working on specific domains. |

| Scalability | Limited. Must scale the entire application, even low traffic parts. | High. Scale individual services independently based on demand. |

| Complexity | Low initial complexity, but grows into a "big ball of mud" over time. | High initial complexity in deployment, monitoring, and networking. |

| Tech Diversity | One stack for all. Difficult to introduce new technologies. | Polyglot. Use the best tool for each specific job (e.g., Go for payments, Python for analytics). |

| Resilience | Low. A single bug can bring down the entire application. | High. Failure in one service doesn't necessarily impact others. |

Ultimately, there's no single right answer, just the right answer for your specific situation. Here's my rule of thumb based on scars earned in the trenches:

- Choose a Monolith if: You're an early stage startup building an MVP with a small, focused team. Your primary goal is speed to market to validate your core idea. You can always plan to break the monolith apart later once you have product market fit and more resources.

- Choose Microservices if: You're building a complex platform with distinct, independent business domains from day one. If you anticipate scaling different parts of your application at different rates (e.g., your payment processing service will see much higher traffic than your user profile service), microservices give you that granular control.

This decision is foundational. For a more detailed guide on this critical choice, check out our deep dive on how to choose a technology stack without losing your mind.

Selecting the Right Tools for the Job

Once you have an architectural approach, you can start picking the specific tools.

For the backend, languages like Python (with Django) are fantastic for rapid development, while Golang offers incredible performance for high throughput systems.

On the frontend, frameworks like React and Vue dominate, but the choice often comes down to team familiarity and the specific user experience you're crafting.

Finally, the database. This is arguably the most critical component in any fintech stack. While a traditional SQL database like PostgreSQL is often the default choice for its reliability and transaction integrity, distributed SQL databases like CockroachDB are gaining ground. They offer the transactional consistency of SQL with the horizontal scalability and resilience of NoSQL systems—a powerful combination when you can't afford even a second of downtime.

Building a Fortress of Security and Compliance

Let's be blunt. In fintech, security isn't just another feature on the roadmap; it's the entire foundation. A single breach doesn't just cause downtime or bad press. It causes ruin. It evaporates user trust in an instant.

This is the one part of development where there are absolutely no shortcuts. Every decision, from how data is stored to how users log in, has to be viewed through a security first lens.

Data Protection as a Default Setting

Your first principle should be to treat all user data like it's radioactive. You have to protect it at all times, whether it's sitting in your database or zipping across the internet. This means end to end data encryption is non negotiable.

Data at rest, the information stored on your servers and in databases, must be encrypted. Likewise, data in transit, the information moving between a user's device and your backend, must be secured using protocols like TLS. There's simply no excuse for transmitting sensitive financial data in plain text.

Think of it this way: if a hacker somehow managed to walk out with one of your hard drives, the data on it should be completely unreadable and useless to them. That's the level of protection we're aiming for. For a deeper look into how these different encryption methods work, our article explaining symmetric vs asymmetric keys through Hollywood magic is a great place to start.

Mastering Identity and Access

Knowing who is accessing your system is just as crucial as protecting the data itself. This is where robust identity and access management (IAM) comes into play. You need strong authentication mechanisms to ensure users are who they claim to be.

This goes way beyond simple username and password combinations. Implementing protocols like OAuth 2.0 allows for secure delegated access, which is essential when you start integrating with other services. Multi factor authentication (MFA) should be standard, not an optional upgrade. One report showed that MFA can block over 99.9% of account compromise attacks. It's a no brainer.

Navigating the Compliance Labyrinth

Now we get to the real maze: regulations. Compliance isn't optional; it's a legal requirement that shapes how you build your product from the ground up. Ignoring it is like building a skyscraper without bothering to check the local building codes.

Before we go deeper, here's what you should have in mind. These are the big acronyms you absolutely cannot ignore:

- PCI DSS (Payment Card Industry Data Security Standard): If you handle card payments, this is your bible. It dictates strict rules for storing, processing, and transmitting cardholder data.

- KYC (Know Your Customer): These are the procedures for verifying the identity of your users to prevent fraud and money laundering.

- AML (Anti Money Laundering): This involves monitoring transactions for suspicious activity to combat illegal financial operations.

These aren't just checklists to tick off before launch. They demand a "security by design" approach, where compliance is woven into every single sprint. This means integrating security scanning tools like SAST and DAST directly into your CI/CD pipeline, making security a shared responsibility for the entire dev team.

To truly build a fortress, embracing strategies like compliance process automation in fintech is no longer a luxury, but a necessity. It helps ensure these complex rules are followed consistently, every single time.

The Hidden Power of APIs and Embedded Finance

Let's be honest, the future of finance isn't going to be yet another app cluttering up your home screen. It's something far more subtle—seamless, integrated, and almost invisible. This is the whole idea behind embedded finance, a trend that's completely changing the game for fintech application development.

Instead of building a banking app that you have to beg users to open, you bring the financial tools directly to them, right inside the platforms they already use and trust every day.

Picture this: a small business owner is in their accounting software, reviewing quarterly numbers. Instead of navigating to a separate bank website to apply for a loan, a button appears right on their dashboard. It offers pre approved financing, calculated from their real time cash flow. That's the magic of embedded finance in action.

APIs: The Engine of Integration

This kind of seamless integration is powered by Application Programming Interfaces, or APIs. Think of an API as the messenger that allows different software systems to talk to each other. In the fintech world, they're the essential bridges connecting your application to the core financial infrastructure.

But a word of warning—not all APIs are created equal. I've learned from painful experience that a great financial API has a few non negotiable traits:

- Crystal Clear Documentation: I once burned hours debugging an integration, only to discover the API documentation was completely out of date. Good documentation is an absolute lifesaver. It must be clear, concise, and packed with practical examples. We actually cover this in detail in our guide on API documentation best practices for 2025.

- Ironclad Security: The API has to enforce strict authentication and authorization protocols. There's no room for error here; you have to ensure only the right people can access the right data.

- Rock Solid Reliability: Financial transactions are the last place you want to see downtime. The API needs to be stable, performant, and have predictable uptime you can count on.

To Build or To Partner? That Is the Question

This brings you to a massive strategic fork in the road on your development journey. Do you build all of this complex financial plumbing from scratch, or do you partner with a specialized provider?

Building your own infrastructure gives you the ultimate level of control, but it's an enormous undertaking. You're not just writing code; you're diving headfirst into a labyrinth of licensing, compliance regulations, and painful security audits.

This is where Banking as a Service (BaaS) providers enter the picture. They offer a whole suite of compliant, ready to use APIs for just about everything, from opening accounts to processing payments. Leaning on a BaaS partner can dramatically slash your time to market.

The core trade off here is speed versus control. BaaS gets you to market fast, freeing you up to focus on what matters most: the user experience. Building it all yourself is a long, expensive road but offers maximum flexibility down the line. For most startups, the answer is clear: partner up.

Embedded finance is fundamentally changing how banking services are delivered. It's projected that by 2030, the majority of non financial companies will offer these kinds of integrated financial services, making it a critical trend you can't afford to ignore.

Surviving Deployment and Life in Production

Shipping your code feels like the finish line, but it's really just the start of a marathon. In fintech, the real work begins the moment you go live. How you manage your application in production—how you deploy, monitor, and react to incidents—is every bit as critical as the code itself.

After all, you're building systems that people trust with their financial lives. The system is now a living, breathing thing, and it's your job to keep it healthy.

From Code Conveyor Belt to Guardian Pipeline

Your CI/CD pipeline can't just be a simple conveyor belt shuttling code from development to production. It needs to be a guardian, a gatekeeper that ensures only pristine, secure code makes it through. This means building in automated security scans, dependency checks, and compliance verifications at every single stage.

I learned this the hard way on a project years ago. We pushed a deployment that brought a critical service crashing down. The culprit? A simple, misconfigured secret that was completely missed in a manual review. That one painful incident pushed our team to fully embrace Infrastructure as Code (IaC) using tools like Terraform.

With IaC, our entire infrastructure—servers, load balancers, databases, you name it—is defined in code. It's version controlled, peer reviewed, and testable, just like our application code. This simple shift drastically reduces the risk of human error during deployment.

This change in mindset turned deployments from a high stress, all hands on deck event into a routine, automated process we could actually trust.

The Art of Obsessive Monitoring

In the fintech world, you have to know about a problem long before your customers do. This requires an almost obsessive approach to monitoring and alerting. Generic CPU and memory alerts just won't cut it; you need metrics that are directly tied to the health of the business.

Your monitoring strategy has to be smarter. Here's what works for us:

- Structured Logging: Stop logging random, unformatted strings. Use a structured format like JSON that includes crucial context like user IDs, session IDs, and transaction IDs. I promise, this will make debugging a thousand times easier when things go wrong at 3 AM.

- Meaningful Alerts: Set up alerts for events that actually matter. A sudden spike in failed payment transactions or an unusual number of login failures from a single location are signals you need to investigate immediately.

- Actionable Dashboards: Build dashboards that give you a real time pulse of your application's health. Track key performance indicators like payment success rates, API latency, and new user sign ups.

To bake quality and compliance into every step, an Automated Testing Tools Comparison can help you pick the right solutions to integrate directly into your pipeline. This proactive approach is the foundation of any production grade system.

The global nature of fintech also means keeping an eye on regional trends. For instance, Central and Eastern Europe (CEE) has exploded as a fintech hub, with startups raising over €2.3 billion in 2024 alone. This kind of growth highlights the need for robust, scalable systems that can handle diverse markets and complex regulatory landscapes.

Common Questions I Hear About Fintech App Development

After walking through the entire development journey, from that first discovery call to the final deployment, a few questions always seem to surface. These are the practical, "in the trenches" concerns I hear from founders and tech leads all the time.

Let's skip the theory and get straight to the real world answers based on years of building these exact systems.

What's the Single Biggest Mistake to Avoid?

Easy. Treating security and compliance like a checkbox you tick off at the end. It's a fatal trap, especially when you're feeling the pressure to just launch something.

In fintech, you can't "move fast and break things." A security flaw isn't just a bug; it's a catastrophe. It leads to direct financial loss for your users, attracts crushing legal penalties, and instantly destroys any trust you've managed to build.

You have to weave security and regulatory requirements into the very fabric of your architecture from day one. This means secure coding is non negotiable, you're running vulnerability scans constantly, everything is encrypted everywhere, and you have a deep, practical understanding of the rules that govern your market—think PCI DSS, GDPR, KYC, and AML.

Seriously, How Much Does a Fintech App Cost to Build?

This is the classic "how long is a piece of string?" question, but I can give you a realistic ballpark. The bottom line is that it costs more than your average app, period. The intense security and compliance overhead is a significant factor you can't ignore.

- A focused Minimum Viable Product (MVP), like a simple budgeting tool or a niche payment app, might start in the $50,000 to $100,000 range.

- However, a complex platform with custom lending algorithms, investment features, and multiple third party integrations can easily soar into the hundreds of thousands, if not more.

The main levers pulling that cost up or down are:

- Feature Complexity: The more sophisticated your financial logic, the more it costs. A simple ledger is one thing; a real time options trading engine is another beast entirely.

- Security & Compliance: The level of auditing, penetration testing, and specialized engineering required adds up.

- Team & Location: The size of your engineering team and where they're located will heavily influence the budget.

- Ongoing Costs: Don't forget that hosting, maintenance, and API license fees are recurring expenses.

Should I Use a BaaS Provider or Build My Own Infrastructure?

For 99% of startups, partnering with a Banking as a Service (BaaS) provider is the only logical choice. I can't stress this enough—it's the faster, smarter path to market.

Building your own financial infrastructure from scratch is an unbelievably complex, expensive, and painfully slow journey. You're not just writing code; you're navigating a minefield of regulatory hurdles that require massive capital and a dedicated legal team before you can even write a single line of code.

A BaaS provider gives you pre built, compliant APIs for core banking functions like opening accounts, issuing cards, and processing payments. This lets you pour your limited time and money into what actually makes you unique: your user experience and core value proposition.

You should only even begin to consider building your own infrastructure once you've hit massive scale and are ready to take on the monumental burden of licensing and compliance yourself.

Building a production grade fintech application is a huge undertaking, but you don't have to figure it all out alone. If you're looking to bring in a seasoned engineering expert to solidify your technical foundation and ship robust, scalable systems faster, Kuldeep Pisda can help. Learn how my consulting can help your startup succeed.

Become a subscriber receive the latest updates in your inbox.

Member discussion